Why diversification is an essential investment strategy

What is diversification?

Diversification (di·ver·si·fi·ca·tion | noun) The process of spreading your money across a variety of investments that don’t all react the same way during periods of market volatility.1

Putting all your eggs in one basket, putting it all on the line, or betting the farm. Whichever idiom you choose, diversification may be considered the opposite of that. It’s a tried-and-tested investment strategy that aims to lower risk in your portfolio2.

By spreading your investment dollars across different types of assets, such as stocks, bonds and cash, as well as different companies, industries, currencies and regions, you can help increase the value of your portfolio while lowering the impact of market declines.

After all, to choose another common idiom, variety is the spice of life.

What is an asset class?

Asset class (ass·et class | noun) A grouping of investments with similar features1.

There are three main asset classes: stocks (or equities), bonds (or fixed income) and cash. Other assets such as gold, real estate, private assets, and cryptocurrency are considered “alternative” investments.

Each one has different investment characteristics, including the level of risk to the investor, the potential for returns, and the way they react to different market conditions.

For example, stocks have historically gone up in value faster than bonds, but when markets slow down, they also tend to depreciate faster. Consider also that when stock prices fall, investors may retreat to the perceived safety of bonds, which can in turn lead to higher bond prices. For these reasons, holding a mix of both stocks and bonds can help enhance the stability of your portfolio.

Diversification checklist

A well-diversified portfolio consists of investments in:

- different asset classes

- a variety of industries

- different-sized companies

- diverse geographic regions and currencies

Why is diversification important?

A well-diversified portfolio can help reduce volatility associated with one type of investment, which is often considered an important factor when evaluating long-term investment outcomes.

Concentrating your investments in a few hot stocks or sectors – renewable energy, or U.S. technology, for instance – can be exhilarating, but it’s often not sustainable over time. Historically, the hot investment in one year is often replaced by a different hot investment the following year. It’s almost impossible to predict winners consistently, and when they falter, this can lead to a decline in your wealth over time.

No single type of investment is consistently among the top performers, and the best and worst performers can change from one year to the next. A diversified portfolio provides an opportunity to participate in potential gains of each year’s top asset classes while lessening the negative impact of those at the bottom.

Think global diversification strategy

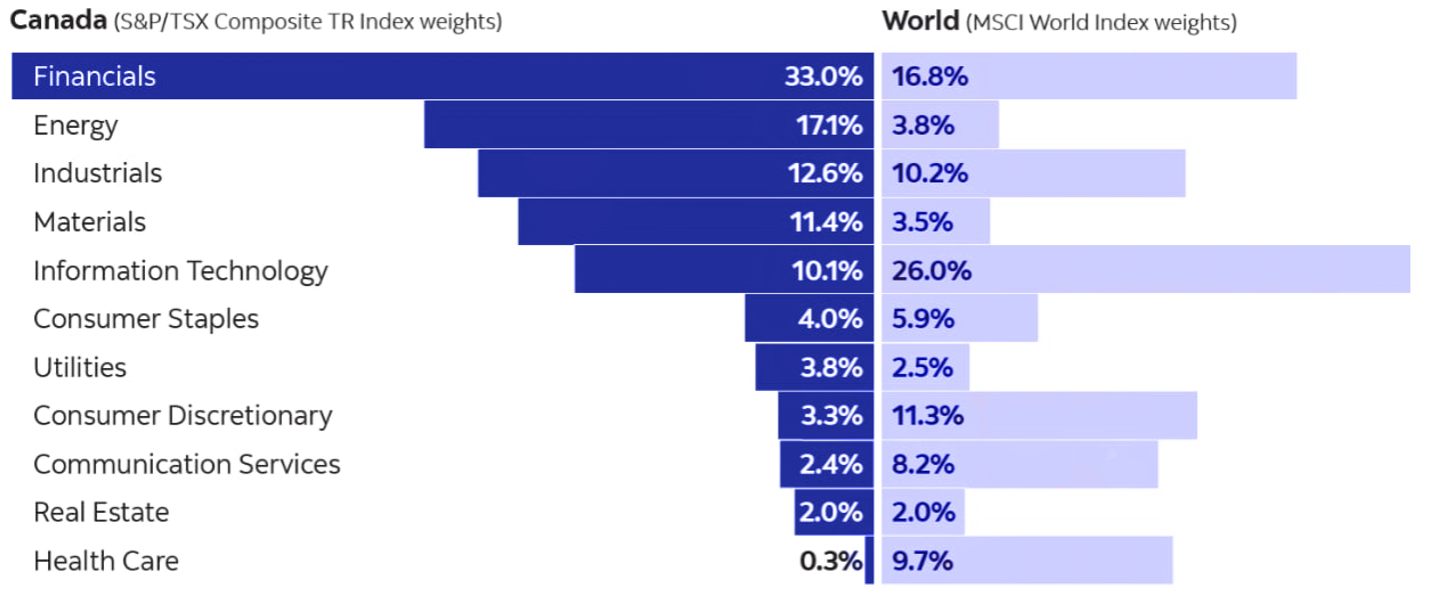

Canada represents only about 3% of the global stock market, with over half concentrated in the financial, energy, and materials sectors. So, any Canadian investor thinking of diversifying their portfolio should consider including investments in the broader market beyond Canada. A diversified portfolio that includes exposure to stocks outside of Canada can more easily spread their investments across different sectors that may not be as prevalent in the Canadian market, such as information technology, consumer goods and health care.

Source: Morningstar. For illustrative purposes only. Chart demonstrates sector weightings in the respective index. S&P/TSX Composite TR Index and MSCI World Index are as of December 31, 2024.

Put volatility to work with automatic investing

Diversification is one strategy that can help protect your investments from volatility. Automatic investing is another. Why? Because market swings can make it difficult for investors to decide when to invest – especially when trying to invest one lump sum each year. Consider pre-authorized contributions (called an Automatic Savings Program at Tangerine), which takes the guesswork out of investing.

Investing a fixed amount of money regularly means you automatically buy more units when prices are lower and fewer when prices are higher. This is commonly called dollar-cost averaging. Over time, purchasing units at different prices can smooth out potential volatility.

How do Tangerine Investments help protect against market volatility?

Creating your own well-diversified investment portfolio takes considerable time, knowledge and effort. Tangerine’s Investment Portfolios make diversification easy by providing investors with a mix of investments that span different asset classes, geographies, industries and company sizes in the convenience of a single investment.

To take one example, our Balanced ETF Portfolio contains approximately 40% bonds and 60% stocks. The investments are geographically allocated between Canada (43.3%), the U.S. (37.1%) and international (19.6%)3.

We review our passively managed Portfolios every quarter and rebalance them if we need to, to ensure they remain aligned to their targeted mix of assets.

The bottom line

A well-diversified portfolio can help protect your investments during market downturns while potentially generating higher risk-adjusted returns. Got questions about your Portfolio? Don’t hesitate to give our Tangerine Advisors a call at 1-877-464-5678.

Ready to start investing?

We’ve got simple options that keep your money working for you in the short and long term.

1 Investopedia

2 Diversification does not guarantee a profit or eliminate the risk of loss.

3 Geographical allocation of Tangerine Balanced ETF Portfolio accurate as at April 30, 2025. See Fund Facts for more details.