TFSA and RRSP contributions: What you need to know

If you're like many Canadians, you want to grow your savings and investments as much as possible — especially in this economy where every dollar counts. However, many Canadians are potentially leaving money on the table. They aren't taking full advantage of registered accounts like Registered Retirement Savings Plans (RRSPs, called RSPs at Tangerine) and Tax-Free Savings Accounts (TFSAs). You too may have "unused contribution room" or the opportunity to invest more in your RRSP or TFSA.

If the contribution limits have you scratching your head, let us help you by breaking down the rules around these accounts. Read on to determine how much you can contribute and how your contributions compare to those of other Canadians.

Understanding contribution and deduction limits

Unlike TFSA contributions, RRSP contributions are tax deductible — meaning you can deduct your contributions from your taxable income up to a set limit. However, you don't have to deduct your contributions immediately. If you like, you can wait and deduct them in a future tax year (when your income may be higher). For this reason, the CRA keeps track of both your deduction limit and your available contribution room, and they may or may not be the same.

RRSP contribution room

This number is the maximum amount you can contribute to your RRSP for the year.

Note that to be eligible to contribute to an RRSP, you need earned income, which the CRA defines as including "employment earnings, self-employment earnings, and certain other types of income, less specific employment expenses and business or rental losses."

RRSP deduction limit

Your RRSP deduction limit is calculated for each person and is not a simple set dollar amount. This complicated calculation is based partly on your earned income from the previous year up to a dollar maximum ($32,490 for 2025). The CRA also takes any unused contribution room at the end of the previous year, any pension adjustment, and other amounts into account in the calculation. That's why it's important to check your individual limit, as described below.

Your deduction limit is the maximum amount you can deduct from contributions made to your RRSP account for a year.

TFSA contribution room

Unlike an RRSP, TFSA contributions are not tax-deductible, and you don't need earned income to contribute. Your available TFSA contribution room, which is the maximum you can contribute in any year, is a dollar amount that grows and accumulates yearly for every eligible Canadian.

Here's how available TFSA room is calculated:

Add up the annual TFSA dollar limit for each year since its introduction in 2009. Then, subtract any contributions you made since then.

If you withdraw amounts from your TFSA, you can re-contribute them the following year. So, add any withdrawn amounts to your contribution room.

For example, let's say you never contributed to a TFSA but were 18 or over when the account was introduced in 2009. Your available contribution room in 2026 would be $109,000, including that year's annual contribution limit of $7,000.

If you had contributed $1,000 to your TFSA in a previous year, but withdrew that amount in 2025, you'd get $1,000 back in contribution room for 2026.

RRSP or TFSA?

Does it matter if you put your money in an RRSP or TFSA? That depends on when you need to withdraw the funds.

Let's say you put the same amounts into an RRSP and a TFSA each year and invest in identical portfolios of stocks and bonds in both accounts. If you reinvest your returns and don't make any withdrawals, you'd have the same amount in both accounts today.

However, you'll have to pay tax on the funds when you withdraw them from your RRSP. (Remember, you would have received a tax deduction for your contributions.)

In contrast, although you didn't get a tax deduction for your TFSA contributions, you won't pay tax on the funds whenever you withdraw them — and you don't have to wait until retirement. Read more about the pros and cons of RSPs and TFSAs here.

What happens if I over-contribute?

If you over-contribute to your RRSP, you have to pay a 1% monthly tax on any excess contributions. If you find yourself in this situation, you can withdraw the excess contribution and fill out form T3012A, in order to avoid paying an upfront withholding tax on the withdrawal.

The CRA says this about over-contributing to your TFSA: "If at any time in the year, you contribute more than your available TFSA contribution room, you will have to pay a tax equal to 1% of the highest excess TFSA amount in the month, for each month that the excess amount remains in your account."

How much can I contribute to my RRSP or TFSA? Here's how to check

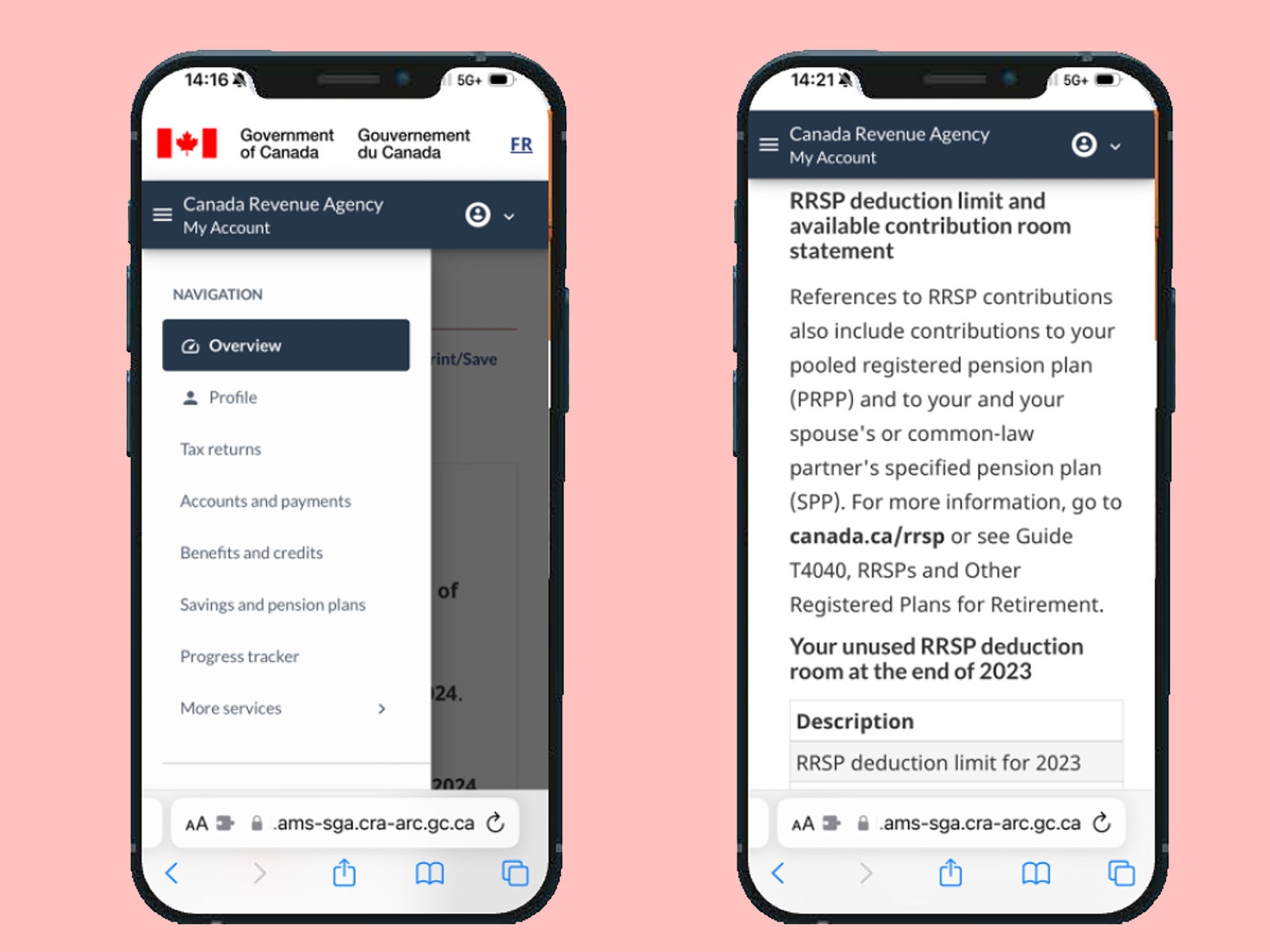

The easiest way to check your RRSP deduction limit and available contribution room, or your available TFSA contribution room, is by logging into the Canada Revenue Agency's My Account for Individuals (or register for one if you haven't already done so). My Account is a secure portal that lets you view your personal income tax information, including tax returns filed for prior years, notices of assessment (NOA), and account balances. You can also call the Tax Information Phone Service (TIPS).

Find your notice of assessment

Once you're logged into your CRA My Account, navigate to your Overview page and click the section called "Tax returns" to pull up a list of prior years' tax returns and NOAs. Select the most recent (2023) notice of assessment and scroll down to the bottom to "Your 2024 RRSP deduction limit." The last line indicates your available RRSP contribution room for 2024. Note that if your available RRSP contribution room is negative, you have no contribution room for 2024.

Find the "Savings and pension plans" section

Return to your Overview page, and you'll see another section called "Savings and pension plans." If you click there, it takes you to a detailed page that indicates your RRSP deduction limit (note: the available contribution room is not provided here but can be calculated as described above) and your current TFSA contribution room. This page also includes information about your use of the Home Buyers' Plan, First Home Savings Account (FHSA) and Lifelong Learning Plan.

If the CRA still needs to update your RRSP deduction limit or TFSA information for the year, keep checking back. The CRA also issues this warning: "You should compare the TFSA transaction information we have with your own records to ensure that the information we have on record is correct. Your previous year's transactions may not have been received or processed by CRA and therefore would not yet be reflected in the amount."

How do your contributions compare to other Canadians?

Everybody's financial situation is unique, but if you’re interested in how your contributions compare to other Canadians, here’s where they stand.

Canadians' average TFSA contributions

The average TFSA contribution total for all Canadians 18 and older was just under $30,000 as of April 2024. As you may expect, older Canadians have contributed more in total on average than younger ones, with those 65+ contributing almost $35,000, compared to those 18-24 years old contributing just under $23,000.

Canadians' RRSP contributions

Some 21.7% of Canadian tax filers reported making RRSP contributions in 2022, and this varied widely by province and territory. This percentage has been trending down since 2000, when 29% of tax filers contributed to an RRSP.

| As of April 2023 | As of April 2024 | |

|---|---|---|

| All Canadians | $29,342 | $29,802 |

| 18 - 24 | $17,612 |

$22,950 |

| 25 - 34 | $29,577 | $28,584 |

| 35 - 44 | $33,201 | $28,738 |

| 45 - 54 | $27,448 | $31,645 |

| 55 - 64 | $33,236 | $32,103 |

| 65+ | $33,486 |

$34,659 |

(source: Ipsos Canadian Financial Monitor)

The province with the highest percentage of tax filers contributing to their RRSP in 2022 was Quebec, at 26.1%, with the lowest province being Newfoundland and Labrador at 14.5%, followed by Nunavut at 9.3%.

The median contribution for all Canadians in 2022 was $3,910. Older Canadians 55+ had a median contribution of $5,000 in 2022, compared to $3,000 for Canadians 25 - 34 years old.

How do I know if I'm contributing enough?

So, how much do you need to sock away into these accounts? Your optimal contribution amount depends on several factors, including your income, expenses, personal tax situation, and investment goals.

| Canada | $3,910 |

|---|---|

| Newfoundland and Labrador |

$3,540 |

| Prince Edward Island |

$3,400 |

| Nova Scotia |

$3,180 |

| New Brunswick | $3,250 |

| Quebec | $3,830 |

| Ontario | $4,050 |

| Manitoba | $2,600 |

| Saskatchewan | $3,000 |

| Alberta | $3,900 |

| British Columbia | $4,500 |

| Yukon | $4,120 |

| Northwest Territories | $3,900 |

| Nunavut | $4,560 |

(source: Statistics Canada)

There is no "right" amount or "one-size-fits-all" answer, but many Canadians try to "max out" their RRSPs and TFSAs. Setting up regular automatic transfers from your savings or chequing accounts can help you boost your contributions and keep your financial goals on track.

Setting aside money for future you can be a breeze

Our simple RSP options make it easy to build your retirement nest egg.