Chequing

Home Equity Line of Credit

With Tangerine, you can borrow at a low interest rate and tap into the equity you’ve built in your home without breaking your mortgage and paying a penalty.

[[HELOC.RATE]]†

Interest rate

Fixed

Payback Plan

24/7

Online Access

24/7 online access

Withdraw funds, make payments and completely pay off your balance at any time.

Save on interest over time

Set regular fixed payments to help you pay off the principal amount sooner and save you interest over time.

Always there, if you need it

You can pay off the loan at any time and use it again without having to re-apply, provide documents, or pay fees.

What are some large expenses I can cover?

Debt consolidation

Consolidate your high interest debts to a lower interest rate and reduce your monthly payments.

Home renovation

Financing renovations that could potentially add to the value of your home.

Emergency fund

Building your savings for an emergency fund is ideal, but sometimes you need more money to cover a large, unexpected expense.

Keeping you financially afloat

When you’re facing a temporary financial situation and need help to cover expenses without taking on higher interest debt.

Some important things to consider

What will I be using it for?

Avoid tapping into your home equity for unnecessary personal expenses, like day-to-day spending, vacations or shopping trips.

Do I have a repayment plan?

If you’re going to take on any debt, you’ll want to make sure you have a plan to pay it back.

Will this help me in the future?

Determine if your decision to borrow will help improve your finances in the long run or not.

Check out these helpful articles

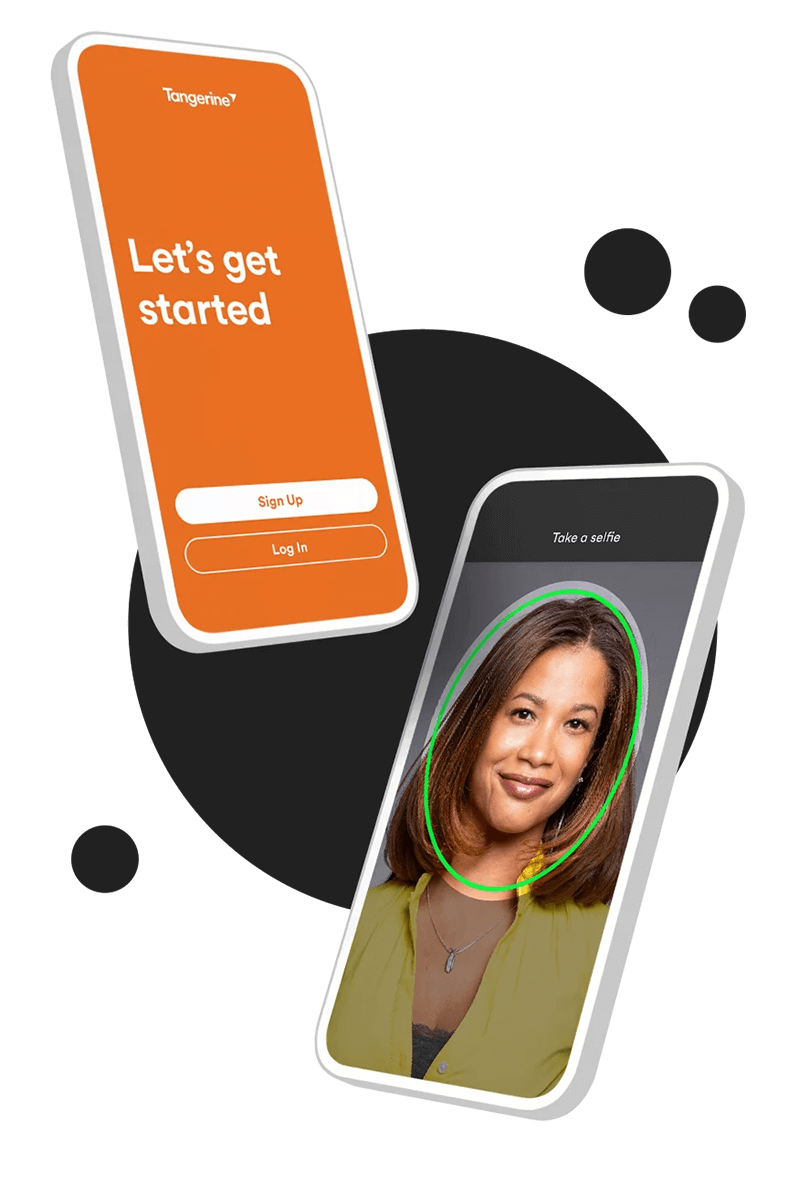

Join with our app

Become a Client completely digitally with our Mobile Banking app3. Sign up without leaving your home or having to call us—it’s a fast, convenient and secure mobile experience.

Don’t have our Mobile Banking app3 yet? Download it today, so you can bank easily from anywhere.

Take a look at our other products

Mortgage

Whether you’re buying a new home or refinancing, we’ll help you get the rate and term that works for you.

Line of Credit

Money that's always there to borrow when you need it, with the flexibility to repay and reuse at your own pace. There's no annual fee, and it only takes minutes to apply.