Power up your investments with automatic contributions

How can you help your portfolio grow without overthinking it? With automatic transfers, a dead simple yet effective trick up any investor's sleeve.

With a pre-authorized contribution program (called an Automatic Savings Plan at Tangerine), you can transfer a set amount of money to your investment or savings account automatically on a regular basis. At times when markets might be experiencing volatility, having regular automatic contributions to your investments can help you avoid emotional decisions and invest for your future. Read on to find out how this works.

No need to time the markets (dollar-cost averaging)

An automatic approach to investing removes concerns about whether it's a good time to invest, because investing a fixed amount of money regularly means you automatically buy more units when prices are lower and fewer when prices are higher. This is commonly called dollar-cost averaging. Over time, purchasing units at different prices can smooth out potential volatility.

One fund, two investment strategies

For example: Let's say one year you plan to put $1,200 into a fund. You can invest all your money at once, or invest $100 each month. The two approaches can have very different outcomes.

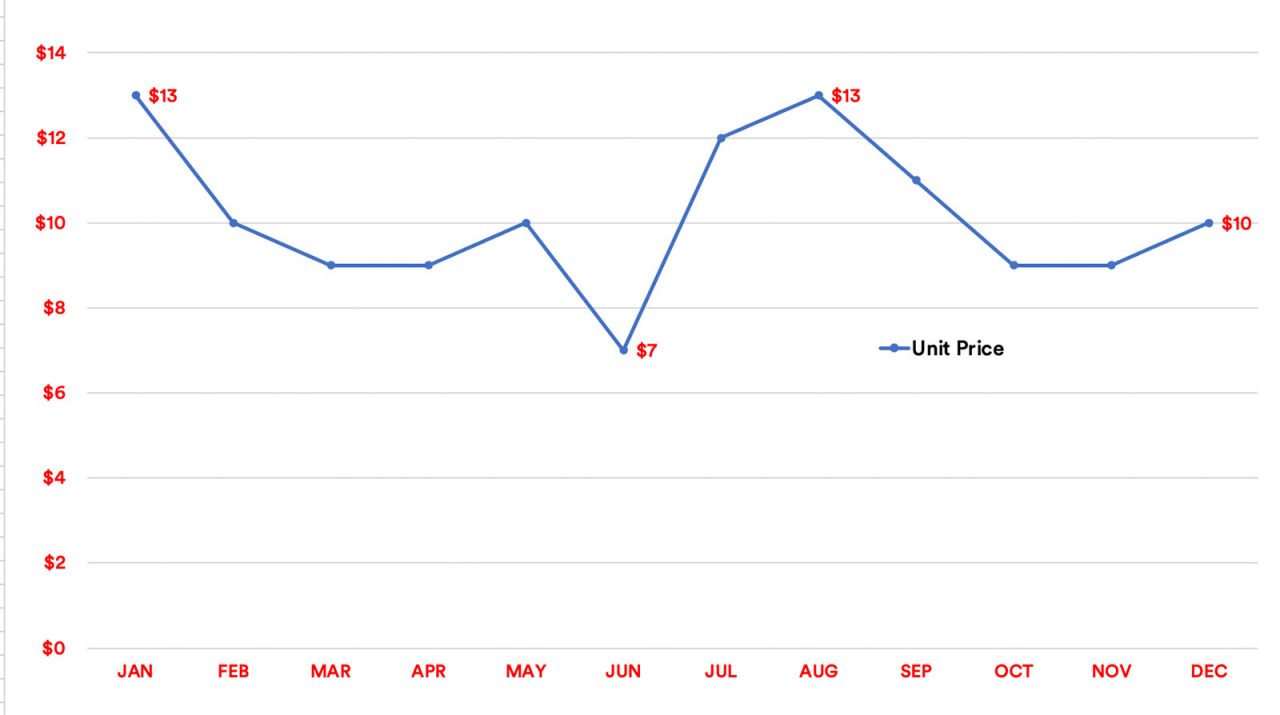

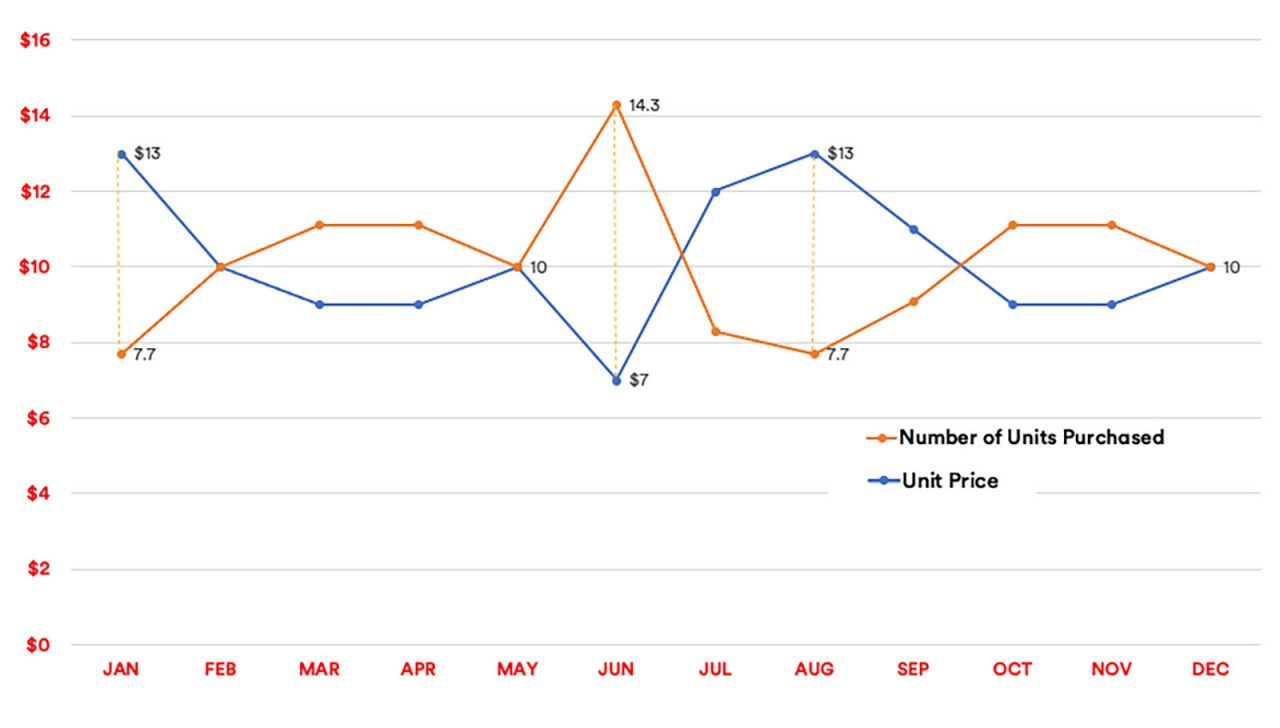

Here's our hypothetical fund, with its unit price fluctuating over the course of the year, starting at $13 and winding up at $10. (Note: all graphs are for illustrative purposes only.)

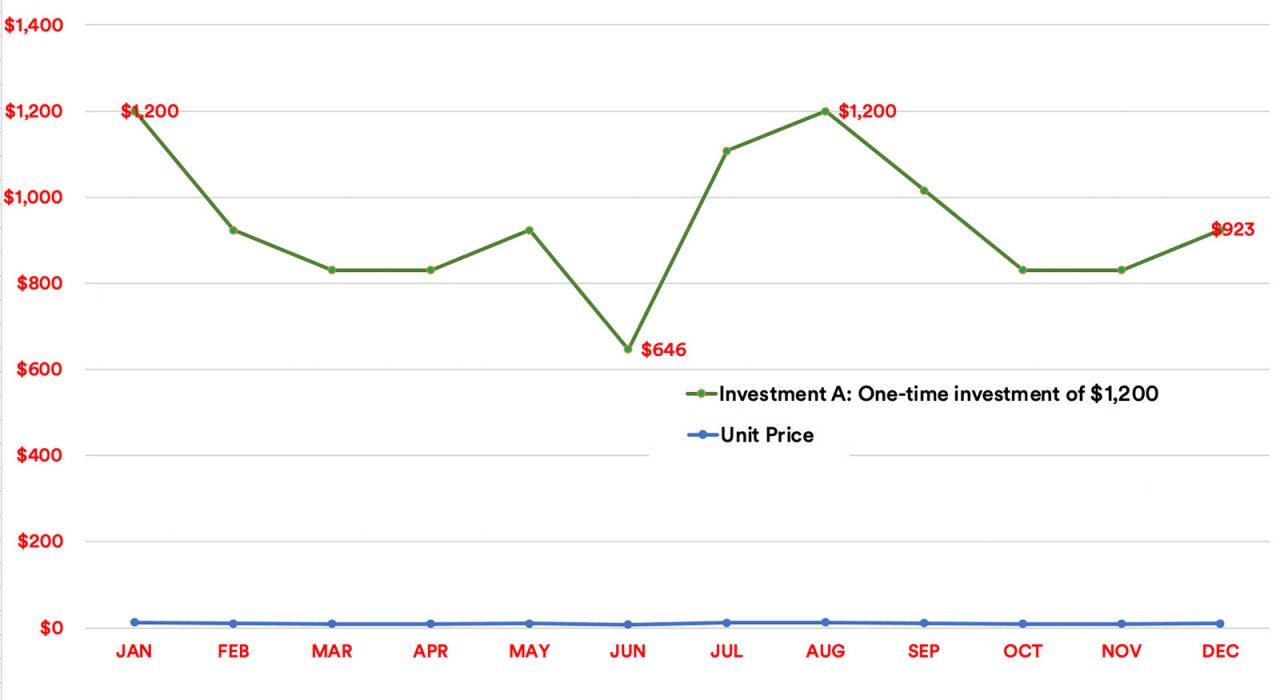

Option A: Invest $1,200 at once

If you put your $1,200 into the fund at the beginning of January, when the unit price is $13, your portfolio will rise and fall over the course of the year. By the end of December, your $1,200 has gone down to $923.

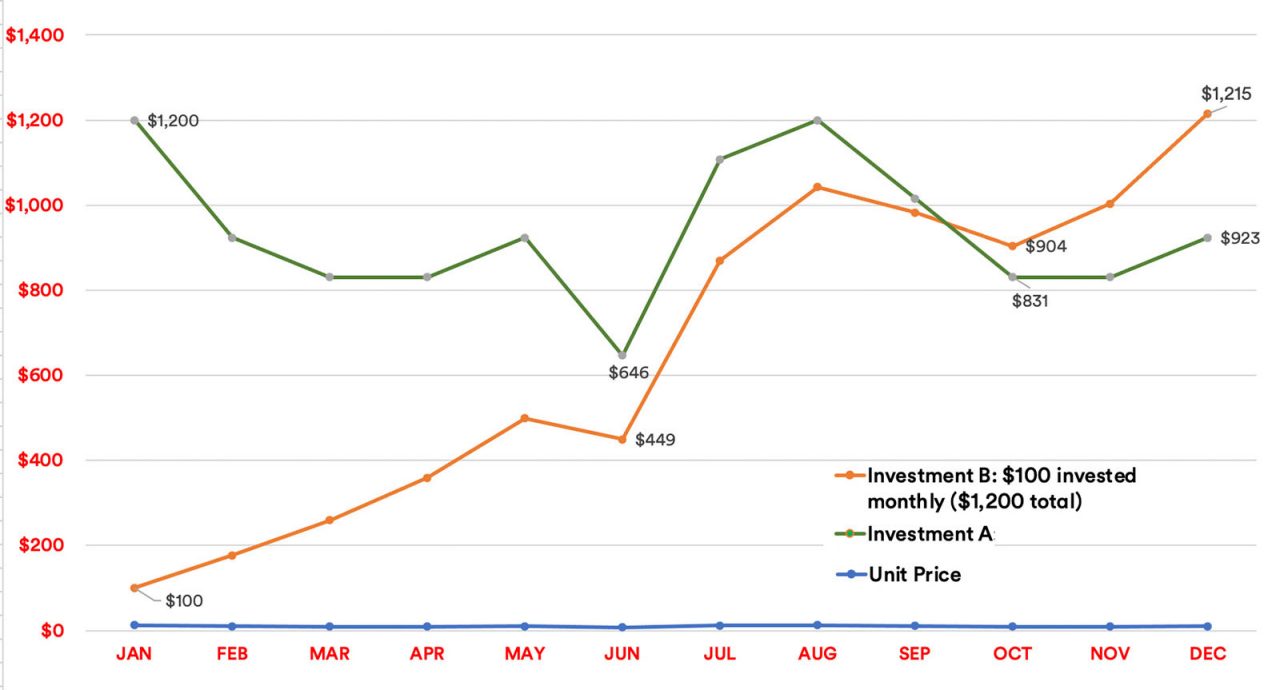

Option B: Invest $100 each month

Now let's see what happens using dollar-cost averaging. With a pre-authorized contribution set up that adds $100 to that same fund every month, the swings of the market level out more. By December, even though the price of the fund has gone down, your holdings stayed stable at $1,215.

How did this happen? Why did the second option perform so much better in this case? It's because when the unit price was down, your $100 monthly contribution was able to buy a greater number of units. This literally pays off once the unit price rises again.

How much of a difference does that make? In Investment A, $1,200 was able to purchase 92.32 units of the fund. Investment B totalled 121.5 units by year end.

Of course, it's worth noting that this is a hypothetical example, and dollar-cost averaging isn't guaranteed to win out over an initial lump-sum investment. If Investor A had put $1,200 into the fund in March instead of January in this scenario, when the unit price was only $9, they would end the year better off than Investor B, with about $1,333.

But dollar-cost averaging is a method that helps investors manage risk and avoid the common trap of trying to guess the best time to invest.

Even small investments could add up over time

The value of your investment has the potential to increase as time passes, and not just because you're adding to it regularly, but because what you've already invested is compounding.

Makes RSP contributions at tax time easier

Instead of waiting until the last minute to make a lump sum RSP contribution, setting up automatic contributions for your retirement tends to be the least painful way to come up with money to contribute to your RSP.

Getting your contribution in by the deadline means you can deduct what you contribute from your previous year's taxable income on your tax return. This is why some people scramble to come up with money to contribute to their RSP, often in a lump sum, often during a time of year when finances might be tight.

Saves time

In today's fast paced world, you're probably busy and on the go. You have enough things to worry about in your life, and investing shouldn't be one of them. After a few months of setting aside money automatically, you may not really feel the contributions anymore, but you'll likely end up setting aside more than you thought you could.